We’re not salesy; our office is relaxed and our processes are simple. We charge initial fees and ongoing fees. Our ongoing fees are set at 0.75%; our initial fees depend on the work involved.

When you come to see us, we’ll ask you about your situation and circumstances, and give you options based on your needs and budget. We’ll make sure we remove the technical language that can make things seem complicated, and make recommendations that are easy to understand.

We won’t pressure you into making a decision right away. You can go away, think about it in your own time, discuss things with family and come back to us with any questions. We want you to feel comfortable with the options available to you and for you to feel as if you have all the relevant information to hand.

Clients come to see us feeling confused, bringing lots of paperwork with them that they’ve collected over the years that they’re not sure about. They leave having unburdened themselves and having reached a solution they can feel confident about in the years to come.

What To Expect

OUR 3-STEP PROCESS

1

Our initial meeting is at no cost to you, and gives you the opportunity to ask questions. It also gives us the chance to explain our processes and fees in more detail. We’ll also ask you about your current circumstances and your attitude to risk.

2

If you agree to work with us, the second meeting enables us to present the report we’ve created for you, which will include our recommendations. You’ll have as much time as you need to think about your options before making a decision.

3

The next stage is to help you stay on track financially. We’ll regularly meet with you to make sure your plan is still right for you. We can change it as we go along, depending on what might happen in your life.

Cashflow modelling

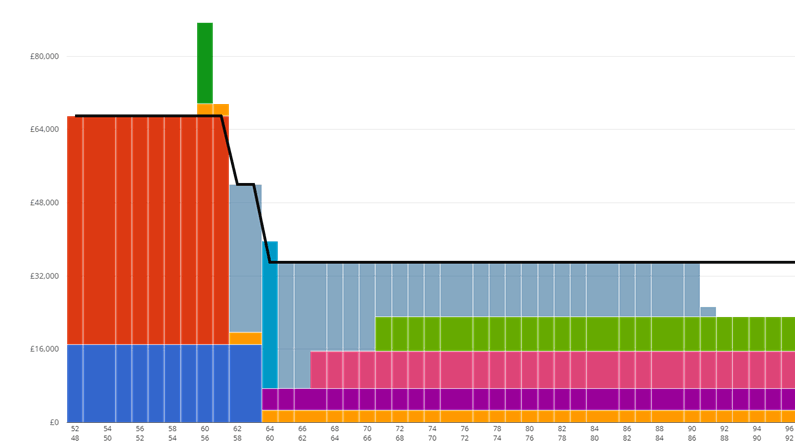

Where relevant, we use ‘cashflow modelling’ software to enable clients to make informed decisions about their money.

The software enables us to estimate your finances in the years ahead using a detailed graph, similar to the one shown here.

It can also show the potential impact of future events on your cashflow, for example, an unexpected expense, or a sudden windfall.

It can be adjusted as your circumstances change, which means you’ll always be able to see what your financial future looks like.

HOW TO PREPARE

We don’t need you to prepare too much before coming to see us.

However, it would be useful if you could have a think about your current incomings and outgoings.

For example, what you spend each month on your mortgage, gas and electric bills and food, clothes and entertainment.

You also might like to give some thought to your long-term goals and what you’d like your future to look like. Perhaps you’ve always wanted to travel the world, write a book or spend more time with your family.

This will help us to plan your financial future.

Get In Touch

We’d love to hear from you. Contact us via the below or complete the form and one of our friendly team will be in touch.

Address

Oakworth House, 45 Newgate, Pontefract, West Yorkshire, WF8 1NB.